We’ve just completed our 2-part webinar series on Orchid’s Inter-Entity Suite for Sage 300, so my antennas are more finely attuned than usual to all things multi-company. That might explain why the news stories referred to below caught my attention.

There are good reasons why today’s organisational structures seem more complex than ever, but, depending on your perspective, there are also some not-so-good ones.

Let’s start this article by taking a journey to the dark side with a couple of case studies.

Case Study 1: The Flying Kangaroo Hits Turbulence

For many North Americans, their first exposure to Qantas, Australia’s national airline, might have been the blockbuster 1998 film Rain Man.

Charlie Babbitt (played by Tom Cruise) said, “All airlines have crashed at one time or another”. His savant brother Raymond (played by Dustin Hoffman) begged to differ, calling out Qantas as an exception.

(The truth is a little more nuanced, as pointed out in this Ask The Pilot article, but Qantas has retained its admirable safety record, regularly topping the AirlineRatings.com world's safest airline rankings.)

That free exposure might have been a PR staffer’s dream. The same can’t be said of more recent publicity.

A good example was last month’s New York Times article How a Storied National Airline Became Reviled in Its Own Country. The long list of scandals, which led to the premature departure of the long-term CEO, included selling tickets on thousands of non-existent flights and influencing politicians to stifle competition, shortly before posting multi-billion dollar profits.

So, how is this relevant?

At the peak of this public outrage, I read that Qantas has split its workforce across 21 external companies and a further 17 subsidiaries.

Why would you choose to create such complexity?

It might have generated a lot of well-paid jobs for lawyers and accountants, but front-line staff like flight attendants and baggage handlers were less impressed. They saw it as a cynical attempt to reduce their wages and conditions, a case quite persuasively put by their unions in this glossy brochure.

This sounds like a classic case of the age-old “Capital vs Labour” tension.

Was it a valid approach to increasing shareholder value, or blatant worker exploitation? Maybe both?

Unfortunately for Qantas, the courts took the workers’ side. In a groundbreaking unfair dismissal case, Australia’s High Court recently upheld a ruling that Qantas had illegally outsourced 1,700 ground handler jobs.

Case Study 2: A League (not quite) of Their Own

With apologies to the 1992 film about the formation of a women's baseball league, our next case study looks at the A-Leagues, Australia’s national professional (soccer) football competitions for men and women.

In 2020, the participating club owners took over control of these leagues, but exactly who really owns them is, well, a bit murky. In this recent article in the Sydney Morning Herald (SMH) we are told that:

- The largest individual shareholder is a holding company registered in Singapore.

- It, in turn, is owned by an ‘aggregator’ company, the registered address of which is a PO Box at Ugland House in the Cayman Islands.

Ugland House, home on paper to nearly 20,000 companies, made global headlines when Barack Obama remarked that it was “either the largest building in the world or the largest tax scam”.

- To complicate things further, the ultimate holding company of the aggregator company is a private equity group registered in the US state of Delaware.

Obama must have been unaware that Corporation Trust Centre in Delaware is the address for more than 200,000 companies! Now THAT sounds like a large building!

The SMH article did not suggest anything illegal or improper in the above arrangements, and neither do we, but it does beg the question…why? The only expert explanations we’ve been able to find relate to tax benefits and secrecy.

So, who does own the largest holding of A-Leagues shares? We have no idea! And it would appear that whoever they are would prefer to keep it that way.

Orchid helps makes light work of the dark arts

We don’t make judgements about why companies have complex structures. We’re happy to leave that to the courts of law and public opinion!

What Orchid Systems has been doing for years is helping businesses manage such complexities by automating the resulting mundane, time-consuming, and error-prone accounting tasks.

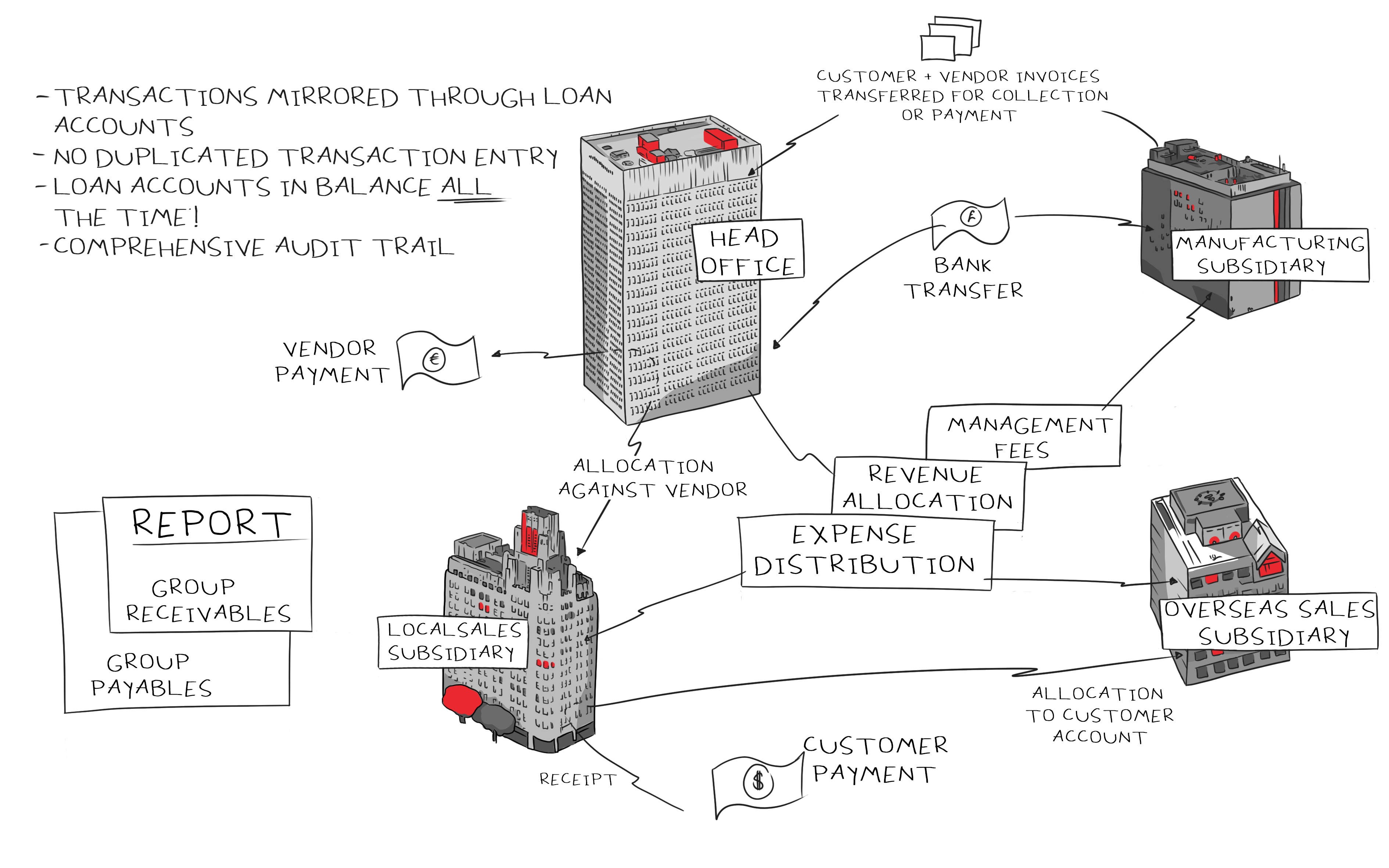

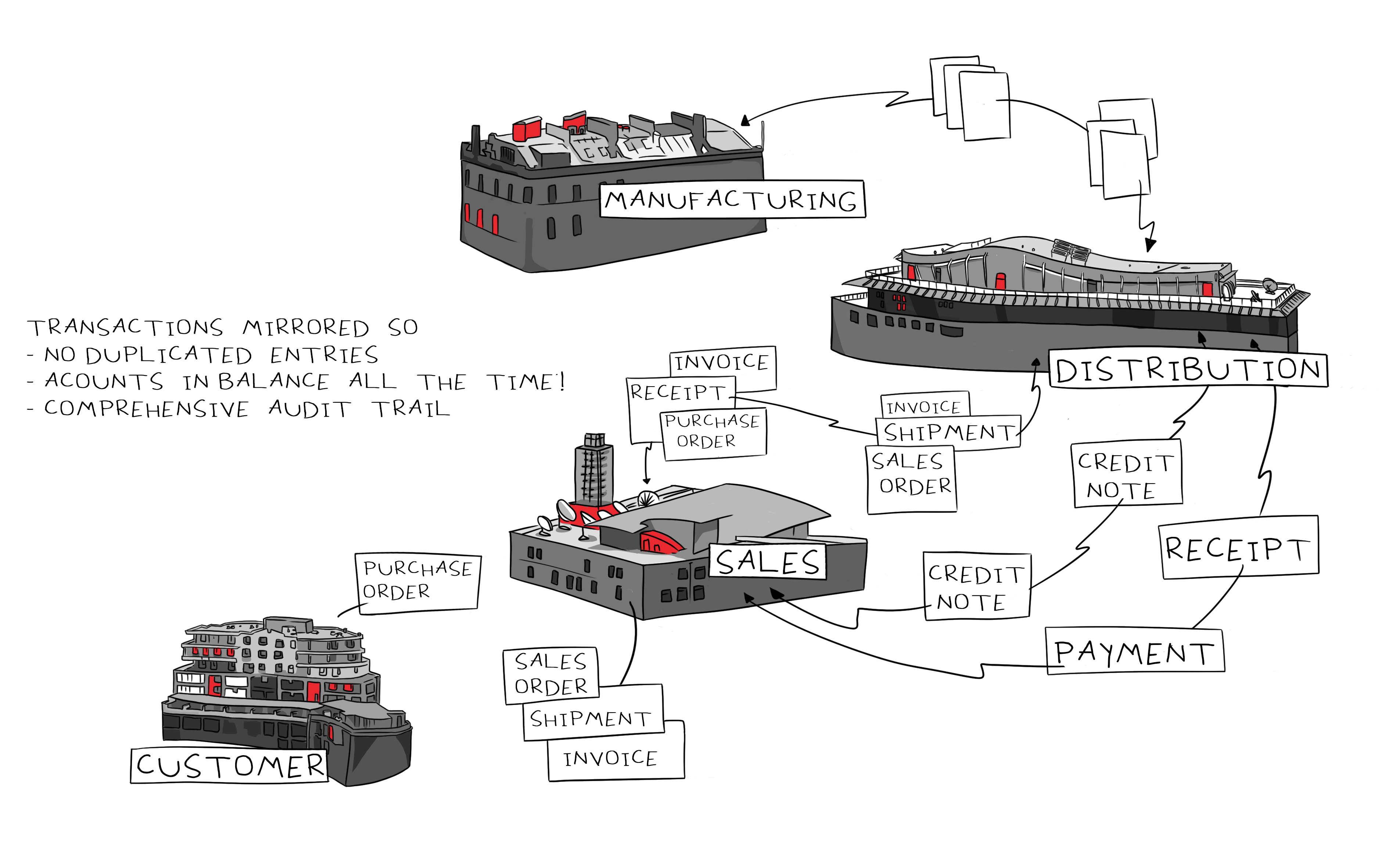

The infographics below illustrate some hypothetical but typical structures and transaction flows that could benefit from using Orchid’s Inter-Entity Suite for Sage 300.

The focus above is on companies, but the related entities could also be branches, divisions, departments, funds, projects, trusts…indeed any entity defined by a segment in the GL chart of accounts.

Inter-Entity Transactions

This Orchid module automatically generates offsetting entries, based on highly configurable rules. The image below illustrates some typical transaction scenarios well suited to it:

- Facilitates the management of allocations and transfers between related entities

- Helps any organization with loan accounts that should mirror each other to reflect inter-entity transaction processing requirements

- Is particularly well suited to non-profit organizations with Fund Accounting requirements

- Work on all GL transactions regardless of whether they originated from the GL, any subsidiary ledger, a 3rd Party module, or an external system that has created GL batches

- Works with entities within one or across multiple Sage 300 databases

- Comes with a detailed audit log to provide transparency and support error checking

Inter-Entity Trade

This Orchid module automates transaction flows when related entities trade goods or services with each other. The image below illustrates some typical trade scenarios well suited to it:

With Inter-Entity Trade:

- You initiate a transaction in one entity, it creates the corresponding entries and reciprocal documents in the other, based on rules you set up

- Accounts remain in balance at all times

- It improves accuracy and auditability in complex organizational structures

- It simplifies collaboration and enhances the visibility of operations across a group of companies

- It includes comprehensive audit logging for transparency, compliance, and reconciliation