If cheques were completely removed today, would your business be ready?

If you think that’s a hypothetical question, the odds are you are in denial, in North America, or perhaps both!

The use of cheques (or checks for our US friends) seems to be so deeply embedded in the US and Canada that some might struggle to imagine life without them. You don’t need to look too hard, however, to find evidence that doing without them, or even doing away with them, is happening all around us.

To quote Wikipedia:

In an increasing number of countries, cheques have either become a marginal payment system or have been completely phased out.

Let’s have a look at some global examples that support that statement.

Europe leads the charge to the exit

With a few exceptions (notably France & the UK), most of Europe never fully embraced paper cheques, so it’s unsurprising to find they are at the leading edge of cheque elimination:

- Finland was well ahead of the game, eliminating the use of cheques in 1993!

- Poland took the plunge in 2006, followed by Denmark in 2017.

- In The Netherlands, all banks had stopped accepting cheques by January 2021.

The reason these nations never fell in love with the cheque is largely due to their long-term affair with ‘giro’ systems. I love this explanation of the difference, again from Wikipedia:

- The writer of a paper cheque is pushing on a rope: they cannot force money out of their own account and into the destination account.

- By writing the paper cheque, they are handing the far end of the rope to the payee, who will pull on it in their own good time.

- In contrast, giro is more akin to a wire transfer in that the payer pushes their money away, towards the payee.

Giro payments pre-date the digital revolution by decades, and in some cases centuries, yet they have a lot more in common with today’s electronic fund transfer (EFT) payments than they do with cheques, including many of the advantages.

Looking South, to Africa

You might also be surprised, as I was, to learn that South Africa formally retired cheques at the end of December 2020. Their government announcement explained that the decision was taken due to the numerous challenges associated with the usage of cheques, including:

- A lengthy processing period

- Fraud perpetrated through the issuing of cheques

- Cheques as an expensive payment instrument

- The restricted acceptance of cheques

- Declining usage

- Limited education and protection for the consumer

- Ageing interbank cheque processing infrastructure

- Impact of the coronavirus pandemic (COVID-19) outbreak

The Payments Association of South Africa (PASA) published this article to explain how they succeeded in achieving this when others have failed, with a strategy that included a gradual reduction in the upper limit for cheques. It ends by saying:

Retiring legacy paper-based payment systems is as much a part of modernising the national payment system as developing digital solutions.

Closer to (our) home

Here in Oceania, the direction of travel is very clear, even in countries where the cheque was king for most of the 20th century.

- In New Zealand, the cheque-clearing system was decommissioned in August 2021.

- The Reserve Bank of Fiji recently announced plans to begin a phase-out in 2024.

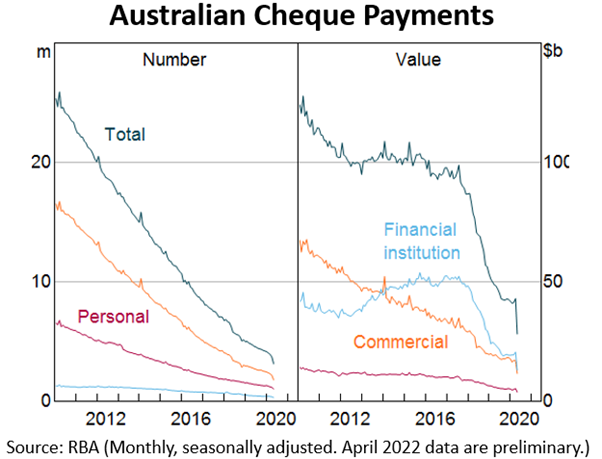

Australia is yet to set a date, but the conversation has started at the Reserve Bank of Australia (RBA). The RBA isn’t driving this change, they are simply responding to dramatic changes in the ways Australians choose to transact:

- The value of cheque payments has dropped by over 95% in the past 30 years.

- Personal cheque use is now virtually non-existent, with what remains being almost exclusively the domain of the over-65 cohort.

- The COVID pandemic triggered a rush towards contactless, paperless payment methods. This saw a further 40% decline in the value of cheque payments for the year to April 2020, and there doesn’t appear to be any rush back.

This led Michele Bullock, Assistant Governor at the RBA, to openly talk about the future of cheques in a June 2020 speech:

Is this suggesting the end of the cheque system? I think it may well be…One option that is actively being considered by the industry is closure of the cheque system.

And she wasn’t just talking about consumer payments, as this chart from the same speech illustrates:

What about the US?

With cheque payment volumes still measured in the billions, it’s easy to think that the US is marching to the beat of a different drum, and the paper check will be around forever. A closer look at the trend tells a rather different story.

This 2019 Federal Reserve Payments Study shows that, while the volumes are still huge by international standards, the trend is clear:

- Between 2000 and 2018, the volume of cheque payments dropped from 42.6 billion to 14.5 billion (a 66% reduction).

- 2018 marked the first year that the volume of ACH (Automated Clearing House) electronic payments exceeded that of cheque payments.

This CPA Practice Advisor article from 2017 provided some very interesting insights about the US experience:

- Before September 11, 2001, huge volumes of paper cheques, representing about $6 billion in payments, were being flown to clearing houses around the US each day.

- Technology for same-day electronic cheque clearances had been around for decades, but was stalled due to outdated legislation requiring cheques to be physically presented.

- The 9/11 attacks triggered the grounding of domestic flights. The havoc this created with cheque clearance processing had huge impacts on both businesses and consumers.

- This triggered the Fed to progress the “Check 21 Act”, eventually adopted in 2004. This authorized fully electronic clearance, permitting the use of digital images of cheques.

- The resulting efficiency dividend, with substantially faster collection times and reduced processing costs, opened many eyes to the benefits of electronic payments.

The article goes on to say that:

The death knell has already sounded for paper checks. Square’s takeover of Bank Of America’s former check processing building in downtown San Franciso...tells us a lot about the future of payments.

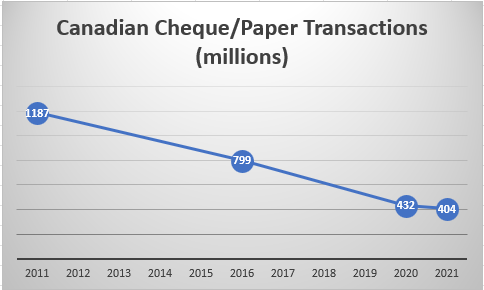

How about Canada?

The numbers are smaller, but the trend is remarkably similar to the US. What better source to illustrate this than Payment Canada’s Canadian Payment Methods and Trends Report 2022? Some relevant points it made:

- Cheque payment volumes have fallen by 49% over the past 5 years, and 66% over the past 10 years (see table below).

- They now make up only 2% of payments by volume.

- They still make up 30% by value, largely due to the “perceived need” for certified cheques when purchasing properties.

- Cheque usage is also tied to generational differences…older people prefer paper due to familiarity.

- Many mid-market businesses have switched from cheques to EFT payments to cover business expenses such as payroll, rent, and government payments.

Time to say goodbye to the paper cheque?

Banks, businesses, and consumers are voting with their feet when it comes to the paper cheque. In many countries, the last cheque has already left the building. The drivers of this trend are pretty much universal, and the Payment Canada report referred to above put it quite succinctly:

Individuals and businesses replaced cheques with digital payments for traditional cheque use cases…because of perceived convenience, speed, security, and low cost.

As the examples above illustrate, getting rid of the cheque completely is possible where alternatives like giro payments are well-established and universally accessible. It gets much harder when the use of cheques is firmly embedded, particularly for the ‘last 10%’ where a transition to electronic payments is problematic. Examples of challenging use cases include payments to a recipient:

- Whose physical address is known, but not their bank account

- Who doesn’t have a bank account

- Who is not digitally engaged (e.g. elderly, disadvantaged)

- Who lives in a remote location with poor (or no) internet coverage

UK Case Study – A Cautionary Tale

The UK Payments Council was established in 2007 to represent the interests of banks and other financial institutions.

- In 2010 they announced their intention to phase out cheques by late 2018, arguing they were in terminal decline.

- In 2011, following protests from charities, small businesses, and older people, they were forced into a humiliating backdown. They announced that “cheques will remain for as long as customers need them”.

- A Treasury Select Committee described the matter as a debacle.

- In 2015 the Payments Council was disbanded, and its regulatory powers were transferred to a new body.

Orchid’s EFT Solutions

While the life of the paper cheque may have some way to run in countries like Australia, Canada, and the US, small and medium-sized businesses have been taking matters into their own hands for years.

The benefits of replacing paper cheques with Electronic Funds Transfer (EFT) are clear, particularly where most payments are business-to-business, or to employees, and the impediments listed above tend not to be an issue.

EFT Processing, the leading Sage add-on from Orchid Systems, has helped thousands of businesses make this transition.

800+ bank formats are already supported, with new ones created on request.

- EFT Processing for Sage 300, which also works with Sage 300 US & Canadian Payroll, has been established for over a decade.

- EFT Processing for Sage Intacct is a more recent addition to the Orchid portfolio, but is already making its mark.